Campbell's College

From our archives: Alan Campbell's thoughts on the Chartered Secretary

2016 End of the year thoughts….

With the Institute expanding its name to “ICSA – the Governance Institute” and rumours of further changes I was reminded of something similar happening when I first started teaching the qualification. Originally you studied and became a Chartered Secretary but then people were worried that friends and family would be upset by the word “secretary”. “After all,” they would say, “You do more than take dictation”.

The people that mattered knew who you were- the person in charge of the secretariat and you carried out “administration”. So the name became the Institute of Chartered Secretaries and Administrators. And the Education department under David Lilley took this very seriously indeed with a separate examination in “Professional Administration” with explanations of how administration differed from management. You practised “secretaryship” and we taught what was expected of you as the head of administration.

From the 1920s there had existed the Royal Institute of Public Administration which lasted until 1992. ICSA collaborated with the Institute of Business Administration to produce qualifications for The Institute of Business Administration and Management (IBAM). But these have gone the way of other administration qualifications and faded into history.

Today the new skill required is “governance.” With the FRC leading the way “Governance” and “Good governance” is what we do.

And I ask myself “Will this last or will it go the way of ‘administration’?”

One thing is certain though: from the time the first Mesopotamian secretary put his stylus into the clay tablet, through Henry VIII’s First Secretary Thomas More, to the highest ranks in Government today, one job has never lost its importance, or its name, or its function and that is the secretary.

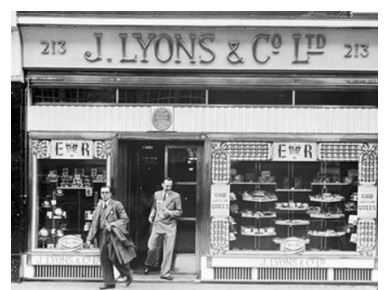

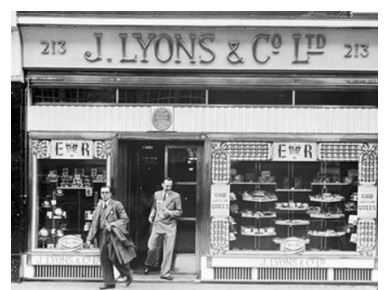

I was reading Dominic Lawson’s article in the Sunday Times of 4th December and was struck by the importance of the Lyons Electronic Office: LEO. He writes “Fully three years before IBM achieved the same in the United States, it was, remarkably a British catering firm founded in 1884 that launched the age of commercial computing.”

As a little boy in the 1950s Lyons Tea Shops and corner houses were a part of any trip to London. They were as much a feature of the city world as McDonalds is today. More amazingly Lyons had brought in a business computer system to speed up the process of branch ordering and so sophisticated was it that the company had to lend it to Ministry of Defence boffins working on the UK’s nuclear defence system. Where had the idea come from? Who had suggested to the board of directors that they should look at a scientific approach to organising their supply systems? Who helped them recruit a group of Cambridge mathematics graduates that would build the first business computer?

It was a man called George Booth, the sole non-family member of the board and he was - the company secretary!

From the archive: Alan Campbell writing about Corporate Governance (May 2016)

One of the features we tend to under-estimate in corporate governance is the degree to which the topic is dynamic, the extent to which it can change. Elements we thought fixed dissolve overnight; fundamental truths turn out to be simple presumptions.

When I studied company law at University, the Law Department was heavily involved in the branch of jurisprudence called “Critical Theory”. One of the main texts was Berle & Means analysis on the collapse of shareholder power and its replacement by the power of the directors. We even had the great economist J.K. Galbraith lecturing us on the power of corporation and the men (there were few women) who ran the companies of the “New Industrial State”.

When I went to Zambia, this idea of controlling the big organisations became the philosophy of “Zambian Humanism” and I was teaching this together with Nyerere’s Ujamaa and Nkrumah’s Consciencism. All involved the State correcting the governance of large corporations by taking controlling stakes. We were ending “neo-colonialism”.

Fast forward to this century: now it was free markets, privatization, globalisation and the business of Cadbury and SOX to guide or order us how to run organisations. The dominance of the executive directors or the government had given way and returned power to the shareholders, in particular the dominance of the institutional investor. Many of you will quote the phrase “If you cannot sell you must care” and will be learning your references to the Stewardship Code.

But governance is changing. Note the rise of private equity: removal from Stock Market – removal from the public arena. This is capitalism from the early days of Brunel and Rockefeller. It is not the same because the funding is from a different source. And that brings us to the Sovereign Wealth Fund: Norway’s pensioners should be glad of theirs: it is one of the wealthiest in the World. This is the State investing in companies: “ujamaa” but with a difference.

But recently the greatest surprise for me was on page 87 of Robert Tricker’s third edition of Corporate Governance. Here is an excerpt:

“However an unintended consequence of changes to tax law and corporate regulation in the UK has been a shift from a longer-term owners market to a shorter-term traders market. In the past institutional investors owned up to 80% of the shares in the London Market. Pension funds and insurance companies owned up to 80% of the shares in the London Market. Pension Funds and insurance companies have been heavy sellers of equities to overseas investors, hedge funds and sovereign wealth funds. Now they account for less than 30% of UK share ownership. At this point their leverage over companies’ behaviour begins to wane.”

The institutions have sold and they have changed the market. The belief that long term development of the company is the aim of share ownership is now problematic. The fact that hedge funds have a different objective to the institutional investors changes the rules: to repeat Tricker we have gone from a long-term owners market to a shorter term traders market. What now of stewardship? Who will be the enlightened shareholder?

So what are the new realities of corporate governance? And just in case you missed it over the last two weeks: what has been happening with the Directors Remuneration Report voting. The Daily Telegraph is calling it a “Shareholder Spring against governance.” Who is leading this Spring?

As long as you are aware that it is still changing and probably accelerating you will be ready to deal with the twists and turns awaiting all of us mixed up with company administration.

Back

QP courses page

2016 End of the year thoughts….

With the Institute expanding its name to “ICSA – the Governance Institute” and rumours of further changes I was reminded of something similar happening when I first started teaching the qualification. Originally you studied and became a Chartered Secretary but then people were worried that friends and family would be upset by the word “secretary”. “After all,” they would say, “You do more than take dictation”.

The people that mattered knew who you were- the person in charge of the secretariat and you carried out “administration”. So the name became the Institute of Chartered Secretaries and Administrators. And the Education department under David Lilley took this very seriously indeed with a separate examination in “Professional Administration” with explanations of how administration differed from management. You practised “secretaryship” and we taught what was expected of you as the head of administration.

From the 1920s there had existed the Royal Institute of Public Administration which lasted until 1992. ICSA collaborated with the Institute of Business Administration to produce qualifications for The Institute of Business Administration and Management (IBAM). But these have gone the way of other administration qualifications and faded into history.

Today the new skill required is “governance.” With the FRC leading the way “Governance” and “Good governance” is what we do.

And I ask myself “Will this last or will it go the way of ‘administration’?”

One thing is certain though: from the time the first Mesopotamian secretary put his stylus into the clay tablet, through Henry VIII’s First Secretary Thomas More, to the highest ranks in Government today, one job has never lost its importance, or its name, or its function and that is the secretary.

I was reading Dominic Lawson’s article in the Sunday Times of 4th December and was struck by the importance of the Lyons Electronic Office: LEO. He writes “Fully three years before IBM achieved the same in the United States, it was, remarkably a British catering firm founded in 1884 that launched the age of commercial computing.”

As a little boy in the 1950s Lyons Tea Shops and corner houses were a part of any trip to London. They were as much a feature of the city world as McDonalds is today. More amazingly Lyons had brought in a business computer system to speed up the process of branch ordering and so sophisticated was it that the company had to lend it to Ministry of Defence boffins working on the UK’s nuclear defence system. Where had the idea come from? Who had suggested to the board of directors that they should look at a scientific approach to organising their supply systems? Who helped them recruit a group of Cambridge mathematics graduates that would build the first business computer?

It was a man called George Booth, the sole non-family member of the board and he was - the company secretary!

From the archive: Alan Campbell writing about Corporate Governance (May 2016)

One of the features we tend to under-estimate in corporate governance is the degree to which the topic is dynamic, the extent to which it can change. Elements we thought fixed dissolve overnight; fundamental truths turn out to be simple presumptions.

When I studied company law at University, the Law Department was heavily involved in the branch of jurisprudence called “Critical Theory”. One of the main texts was Berle & Means analysis on the collapse of shareholder power and its replacement by the power of the directors. We even had the great economist J.K. Galbraith lecturing us on the power of corporation and the men (there were few women) who ran the companies of the “New Industrial State”.

When I went to Zambia, this idea of controlling the big organisations became the philosophy of “Zambian Humanism” and I was teaching this together with Nyerere’s Ujamaa and Nkrumah’s Consciencism. All involved the State correcting the governance of large corporations by taking controlling stakes. We were ending “neo-colonialism”.

Fast forward to this century: now it was free markets, privatization, globalisation and the business of Cadbury and SOX to guide or order us how to run organisations. The dominance of the executive directors or the government had given way and returned power to the shareholders, in particular the dominance of the institutional investor. Many of you will quote the phrase “If you cannot sell you must care” and will be learning your references to the Stewardship Code.

But governance is changing. Note the rise of private equity: removal from Stock Market – removal from the public arena. This is capitalism from the early days of Brunel and Rockefeller. It is not the same because the funding is from a different source. And that brings us to the Sovereign Wealth Fund: Norway’s pensioners should be glad of theirs: it is one of the wealthiest in the World. This is the State investing in companies: “ujamaa” but with a difference.

But recently the greatest surprise for me was on page 87 of Robert Tricker’s third edition of Corporate Governance. Here is an excerpt:

“However an unintended consequence of changes to tax law and corporate regulation in the UK has been a shift from a longer-term owners market to a shorter-term traders market. In the past institutional investors owned up to 80% of the shares in the London Market. Pension funds and insurance companies owned up to 80% of the shares in the London Market. Pension Funds and insurance companies have been heavy sellers of equities to overseas investors, hedge funds and sovereign wealth funds. Now they account for less than 30% of UK share ownership. At this point their leverage over companies’ behaviour begins to wane.”

The institutions have sold and they have changed the market. The belief that long term development of the company is the aim of share ownership is now problematic. The fact that hedge funds have a different objective to the institutional investors changes the rules: to repeat Tricker we have gone from a long-term owners market to a shorter term traders market. What now of stewardship? Who will be the enlightened shareholder?

So what are the new realities of corporate governance? And just in case you missed it over the last two weeks: what has been happening with the Directors Remuneration Report voting. The Daily Telegraph is calling it a “Shareholder Spring against governance.” Who is leading this Spring?

As long as you are aware that it is still changing and probably accelerating you will be ready to deal with the twists and turns awaiting all of us mixed up with company administration.

Back

QP courses page

o

Campbell's College Ltd: Address: 47 Rollo Road, Swanley, Kent. BR8 7RD. Tel: +44 (0) 787 170 1539. Registered in England & Wales No.2892911

Campbell's College is your Recommended CGIUKI Tuition Partner with over 30 years experience.

Campbell's College Ltd: Address: 47 Rollo Road, Swanley, Kent. BR8 7RD. Tel: +44 (0) 787 170 1539. Registered in England & Wales No.2892911